Home Office Schedule C

Home-related itemized deductions claimed in full on Schedule A. However in the home office expense sections of the Schedule C businesses the total mortgage interest is shown as roughly 2500 at the top of the column as an un-editable number.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

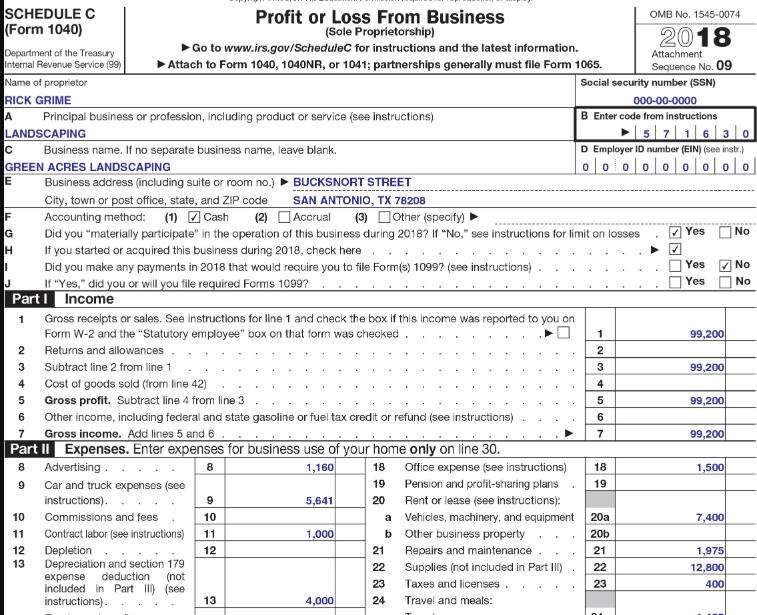

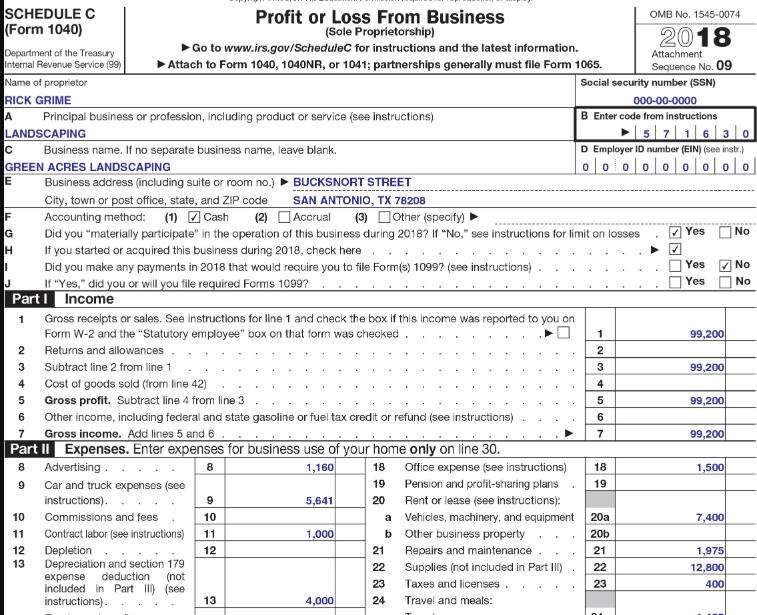

Schedule C Profit Or Loss From Business Definition

Ad For Home And Students Who Want Microsoft 365 Apps Email Installed On 1 Device Buy Now.

Home office schedule c. But if you have capital gains or losses from your home office youll enter the amount on line 29 of your Schedule C plus any gains or minus any losses. Actual expenses determined and records maintained. Get custom crm for your business.

If there is unused business use of home expenses it will carry over to. On Schedule C subtract the home office deduction shown on. Check if the Asset Entry Worksheet is assigned to the 8829 and that it is assigned to the proper Schedule C business that you are working on.

If Schedule C Line 29 shows a Tentative profit complete Form 8829 to compute the home office deduction. Is the Home Office Deduction showing up on Line 30 of Schedule C. Ad Best work from home jobs.

18 MSI y 3 Meses Bonifi. Apply online jobs for UK with highly paid salary. Apply online jobs for UK with highly paid salary.

If you have rental properties you can establish a home office to manage your rental properties and deduct the cost on your Schedule E. If you are a self-employed person classified as a sole proprietor you may deduct as a regular business expense on Schedule C. O Hasta 15 Bonifi.

Conoce las Ofertas en Laptops Desktops Tablets Impresoras y Accesorios de Cómputo. One way of figuring this out is to consider how much time. Firstly a taxpayer can not take a loss on a schedule C using the home office deduction.

Conoce las Ofertas en Laptops Desktops Tablets Impresoras y Accesorios de Cómputo. Thats well below the amount for the whole house and at the same time well above the portion of the 7000 that should apply to the home office based on square footage percentage. Are you accidently using the Simplified Method.

First you must determine the percentage of. But its not available only for your proprietorship partnership or corporate business. Get custom crm for your business.

Is the Home Office deduction being limited by the amount on Line 8 of Form 8829. You can report the home office deduction on federal Form 8829 Expenses for Business Use of Your Home This form is filed along with Schedule C Profit or Loss From Your Business on your personal Form 1040. The business use of home expense can not make the Schedule C income go below zero says Evenstad.

Ad For Home And Students Who Want Microsoft 365 Apps Email Installed On 1 Device Buy Now. How you claim the home office deduction on your taxes will depend on which method you use to calculate your deduction. For starters the home office deduction does have its limitations.

To be considered a home office the area must be regularly used exclusively for your self-employed business. The definition of a home office. Standard 5 per square foot used to determine home business deduction.

Ad Best work from home jobs. If you are an employee working as a one-person corporation you have three options when it comes to home office deductions regardless of whether you are a C Corp or S Corp. F No depreciation deduction.

18 MSI y 3 Meses Bonifi. If you work from your home office as well as another location youll need to calculate how much of your gross income line 7 of your Schedule C came from working at your home office. As you probably know establishing a home office for your Schedule C or corporate business creates valuable tax deductions.

Home-related itemized deductions apportioned between Schedule A and business schedule Sch. If you choose the simplified option use the Simplified Method Worksheet from the Schedule C instructions and then write the value of your deduction on line 30 of Schedule C. O Hasta 15 Bonifi.

Percentage of home used for business. You must file Schedule C Sole Proprietorship with your tax return to take the deduction. For example if your tentative profit before factoring in the home office deduction is 500 and your home office deduction is.

Enter your deduction on Line 34 of Form 8829 then carry it to Schedule C Line 30. You may qualify to claim the home office deduction if you regularly use a portion of your home for your business.

How To Fill Out Form 8829 Claiming The Home Office Deduction Oblivious Investor

What Is Irs Schedule C Business Profit Loss Irs Taxes Irs Tax Forms Tax Forms

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax